Dental Code D9985: Sales tax

Dental Code D9985 refers specifically to the sales tax charged on dental services and procedures. This code is an essential consideration for patients when budgeting and planning for their dental healthcare needs. Understanding the implications of this code can help individuals make informed decisions and ensure they are not caught off guard by unexpected costs.

What does Dental Code D9985 Mean?

Dental Code D9985 is a unique identifier used in the dental industry to denote the sales tax that may be applied to various dental services and treatments. Unlike many other medical procedures, dental care is often subject to state and local sales tax regulations, which can vary significantly from one region to another.

The purpose of Dental Code D9985 is to provide a standardized way for dental practices to communicate the sales tax component of a patient's total bill. This code ensures transparency and allows patients to better anticipate the final cost of their dental care, including any applicable taxes.

Determining Applicable Sales Tax Rates

The first step in the Dental Code D9985 process is for the dental practice to determine the appropriate sales tax rate(s) that apply to the services being provided. This can be a complex task, as sales tax rates can vary not only by state but also by local jurisdiction, such as a city or county. Dental practices must stay up-to-date on the latest sales tax regulations in the areas they serve to ensure they are charging the correct amount.

Calculating the Sales Tax Amount

Once the applicable sales tax rate(s) have been identified, the dental practice must calculate the sales tax amount that will be added to the patient's bill. This is typically done by applying the sales tax rate to the total cost of the dental services being provided. For example, if the total cost of a procedure is $500 and the sales tax rate is 8%, the sales tax amount would be $40 (8% of $500).

Itemizing the Sales Tax on the Patient's Bill

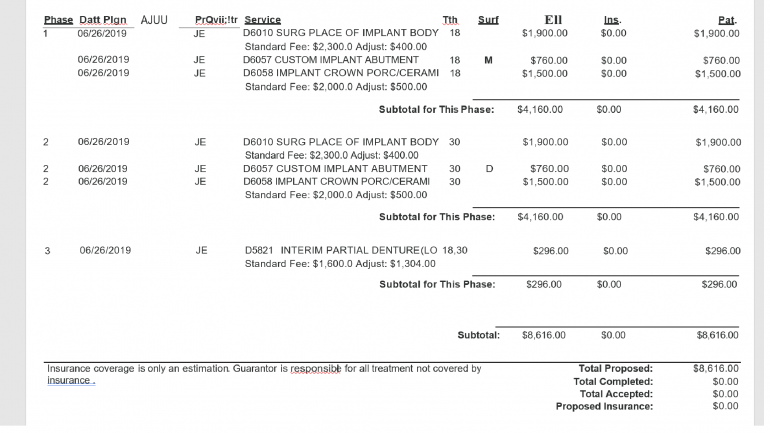

After calculating the sales tax amount, the dental practice will then itemize this charge on the patient's bill or statement. Dental Code D9985 will be used to specifically identify the sales tax component, making it clear to the patient what portion of the total cost is related to taxes.

Collecting and Remitting the Sales Tax

The dental practice is responsible for collecting the sales tax from the patient and then remitting the funds to the appropriate state and local tax authorities. This process ensures that the applicable sales taxes are properly paid and reported, in accordance with the relevant laws and regulations.

Maintaining Accurate Records

Throughout the Dental Code D9985 process, the dental practice must maintain accurate records of the sales tax collected and remitted. This information may be required for auditing purposes or to address any questions or concerns raised by patients regarding the sales tax charges.

Summary of Dental Code D9985

Dental Code D9985 is an essential component of the dental billing and payment process, as it helps to ensure that the appropriate sales taxes are collected and remitted on dental services and treatments. By understanding the steps involved in this code, patients can better anticipate and budget for the total cost of their dental care, including any applicable sales taxes.

Dental practices must remain vigilant in staying up-to-date on the latest sales tax regulations and properly applying Dental Code D9985 to their patient bills. This not only ensures compliance with the law but also promotes transparency and trust between the dental practice and its patients.

Overall, Dental Code D9985 plays a crucial role in the dental industry, helping to maintain financial accountability and transparency for both dental providers and their patients.